Accounting Assumptions

Assumptions are traditions and customs, which have been developed over a period of time and well-accepted by the profession. Basic accounting assumptions provide a foundation for recording the transactions and preparing the financial statements there from. There are four basic assumptions that are considered as cornerstones of the foundation of accounting.

These are:

- Accounting entity,

- Money measurement,

- Going concern and

- Accounting period.

Accounting Entity Assumption

Accounting entity assumption states that the activities of a business entity be kept separate from its owners and all other entities. In other words, according to this assumption business unit is considered a distinct entity from its owners and all other entities having transactions with it. For example, in the case of proprietorship, the law does not make any distinction between the proprietorship firm and the proprietor in the event of firm's inability to pay its debts. Hence, in this situation, to meet the deficit, law requires the proprietor to pay firm's debts from his/ her personal assets. But, these two are treated as separate entities while recording business transactions and preparing the financial statements.

This assumption enables the accountant to distinguish between the transactions of the business and those of the owners. Consequently, the capital brought into the business and withdrawals from the business by the owners will also be recorded in the same manner as that of transaction with other entities. For example, if the owner brings in cash or any other asset, it will result in increase in assets of the business and capital of the firm. This capital represents firm's liability to the owner. The expenses of the owner paid by the firm assets are recorded as withdrawals from the business. This means the profit and loss account will show the revenues and expenses related to the business entity only. Consequently, balance sheet will show the assets and liabilities of the business entity only. This assumption is followed in all organizations irrespective of their form, i.e., sole proprietorship, partnership, cooperative, or company.

Recommended Articles

- Role of Accounting

Accounting is not an end in itself; it is a means to an end. It performs the service activity by providing quantitative financial information that helps the users in making better business decisions....

- Accounting Principles

Basic accounting principles are the general decision rules which govern the development of accounting techniques. These principles, do not violate or conflict with the four basic assumptions discussed above,... - Basic Terms in Accounting

There are two basic financial statements which are prepared by an enterprise: Profit & Loss Statement, and Balance Sheet. The three components of a balance sheet can be stated in the form of following...

Money Measurement Assumption

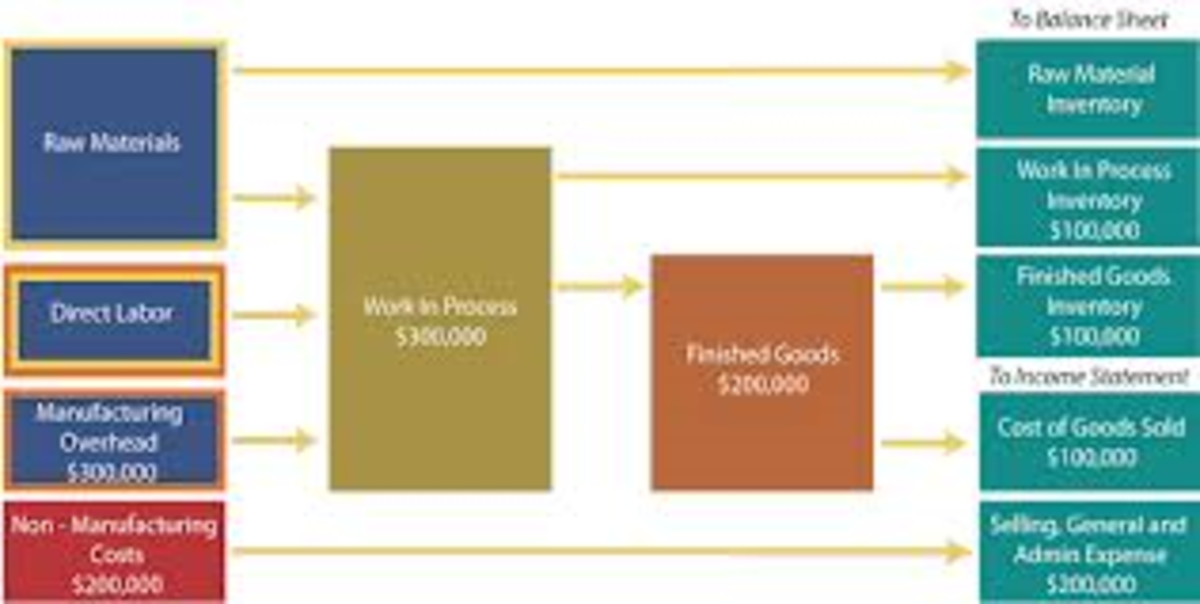

This assumption requires use of monetary unit as a basis of measurement, i.e., the currency of the country where the organization is to report its operations. This implies that those transactions which can not be measured by monetary unit will not be recorded in the books of accounts. Monetary unit is supposed to provide a common yardstick to measure the assets, liabilities and equity of the business. The different items, expressed in varied basis of measurement, like area, volume, numbers, cannot be added together because of heterogeneity of scales of measurement. But, once all these are converted into a homogeneous unit of money, they can be added together or subjected to any arithmetical calculations. It also indicates that certain information; howsoever important it may be to state the true and fair picture of the entity, will not be recorded in the financial accounting books if it can not be expressed in terms of money. For example, the union-management relations, health of the key manager, quality of its manufacturing facilities, etc. can not be expressed in monetary value, and hence, are not recorded in books of accounts.

It is clear from the above that money measurement assumption makes the accounting records clear, simple, comparable and understandable. The acceptability of money as a unit of measurement is not free from problems when we compare the financial statement over a period of time or integrate the financial statements of an entity having operations in more than one nation. This is to be noted that the assumption implies stability of measuring unit over a period of time. This may not be true over a period of time because prices of goods and services may change, hence, the purchasing power (value) of money may undergo changes. But these changes are not usually recorded. This affects the comparability of the financial statements prepared at different time periods.

Going Concern Assumption

The financial statements are prepared assuming that the business will have an indefinite life unless there is evidence to the contrary. The business is called 'going concern' thereby implying that it will remain in operation in the foreseeable future unless it is to be liquidated in the near future. Since, this assumption believes in continuity of the business over indefinite period, it is also known as continuity assumption. The going concern assumption facilitates that distinction made between:

- fixed assets and current assets,

- Short term and long term liabilities, and

- Capital and revenue expenditure.

Recommended Articles

- Trial Balance

A trial balance is a summary of balances of all accounts recorded in the ledger. The trial balance is prepared at the end of a chosen period which may either be monthly, quarterly, half-yearly or annually or... - Suspense Account

In spite of best efforts, locating errors is not an easy task and may take some time. Unless detected and located, errors cannot be corrected. To avoid delay in the preparation of financial statements, the...

Accounting Period Assumption

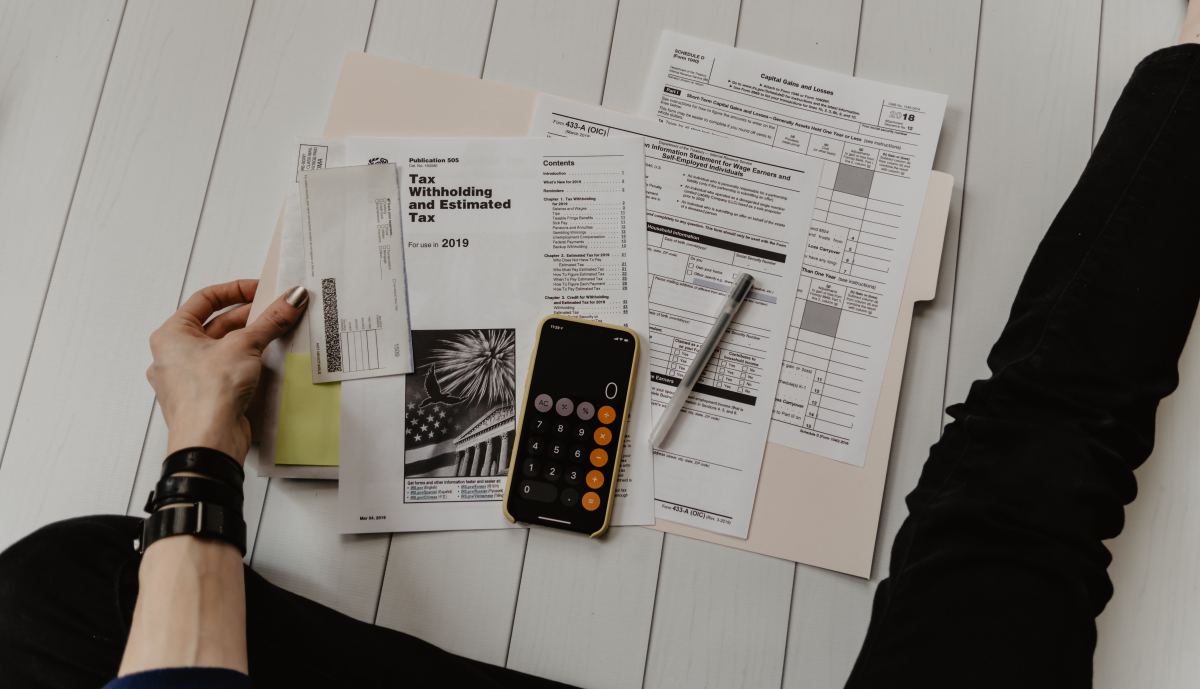

We have stated in the previous paragraph that accountants assume business to be in activities in the foreseeable future. Therefore, results of business operations cannot be truly ascertained before the closure of the business operations. But this period is too long and the users of the accounting information cannot wait for such a long period of time. Hence, the accountants make the assumption of accounting period (also known as periodicity assumption). This assumption permits the accountant to divide the lifespan of the business enterprise into different time periods known as 'accounting period' (quarterly, half-yearly, annually) for the purpose of preparing financial statements. Hence, financial statements are prepared for an accounting period and results thereof are reported on periodic basis.

This assumption requires that the distinction be made between the expenditure incurred and consumed in the period, and the expenditure, which is to be carried forward to the future period. The cut off period for reporting the financial results is usually considered to be twelve months. Usually the same is true for tax purpose. However, in some cases accounting period may be more or less than 12 months depending on the needs of business enterprises. For example, a company can prepare its first financial statements for a period of more than or less than one year. Currently, the interim reports issued by the company, though un-audited are not less reliable. Such information is considered to be more relevant for decision-makers because of timeliness and certainty of information.

This assumption requires deferring of costs that are not related to the revenues of the current period. The assumption of continuity allows depreciation on fixed assets to be charged in the profit & loss account and show the assets in the balance sheet at net book value (cost of acquisition less depreciation). The income measurement is done on the basis of continuity assumption whereby unexpired costs are carried to next period as assets and not charged to current years' income. In those cases, where, it is reasonably certain that the business will be liquidated in the near future, the resources may be reported on the basis of current realizable values (or liquidation value). Also, in such a case, this fact needs to be clearly reported in the financial statements.